University president Alan Garber called the government’s demands “unprecedented,” geared more to “intellectual conditions” than attempts to curb campus antisemitism.

(JNS)

The Internal Revenue Service is “making plans” to end Harvard’s tax-exempt status, sources familiar with the matter stated, according to a CNN report on Wednesday.

The move comes after U.S. President Donald Trump and the federal Joint Task Force to Combat Antisemitism froze $2.2 billion in grants and $60 million worth of contracts to the Ivy League school unless they met certain demands, which Harvard forcefully rejected.

“In recent weeks, the federal government has threatened its partnerships with several universities, including Harvard, over accusations of antisemitism on our campuses,” stated Alan Garber, the Harvard president, who is Jewish. “These partnerships are among the most productive and beneficial in American history.”

Garber said the government’s demands aim to curb Jew-hatred, but that the majority of requests “represent direct governmental regulation of the ‘intellectual conditions’ at Harvard” and called the demands “unprecedented.”

A final decision on the university’s tax-exempt status is expected soon; CNN did not include an exact timeline.

In January, Harvard adopted the International Holocaust Remembrance Alliance’s (IHRA) working definition of antisemitism as part of two Title VI settlements for alleged antisemitic discrimination on campus. The university also recently suspended its partnership with Birzeit University, a Palestinian university near Ramallah in Samaria, also commonly referred to as the West Bank.

JNS has reported that Birzeit has ties to Palestinian terror.

Image: Harvard Yard, Memorial Hall and Cambridge Street at night, seen from the top floor of the Science Center in Cambridge, Mass., July 2017. Credit: Meihe Chen via Wikimedia Commons.

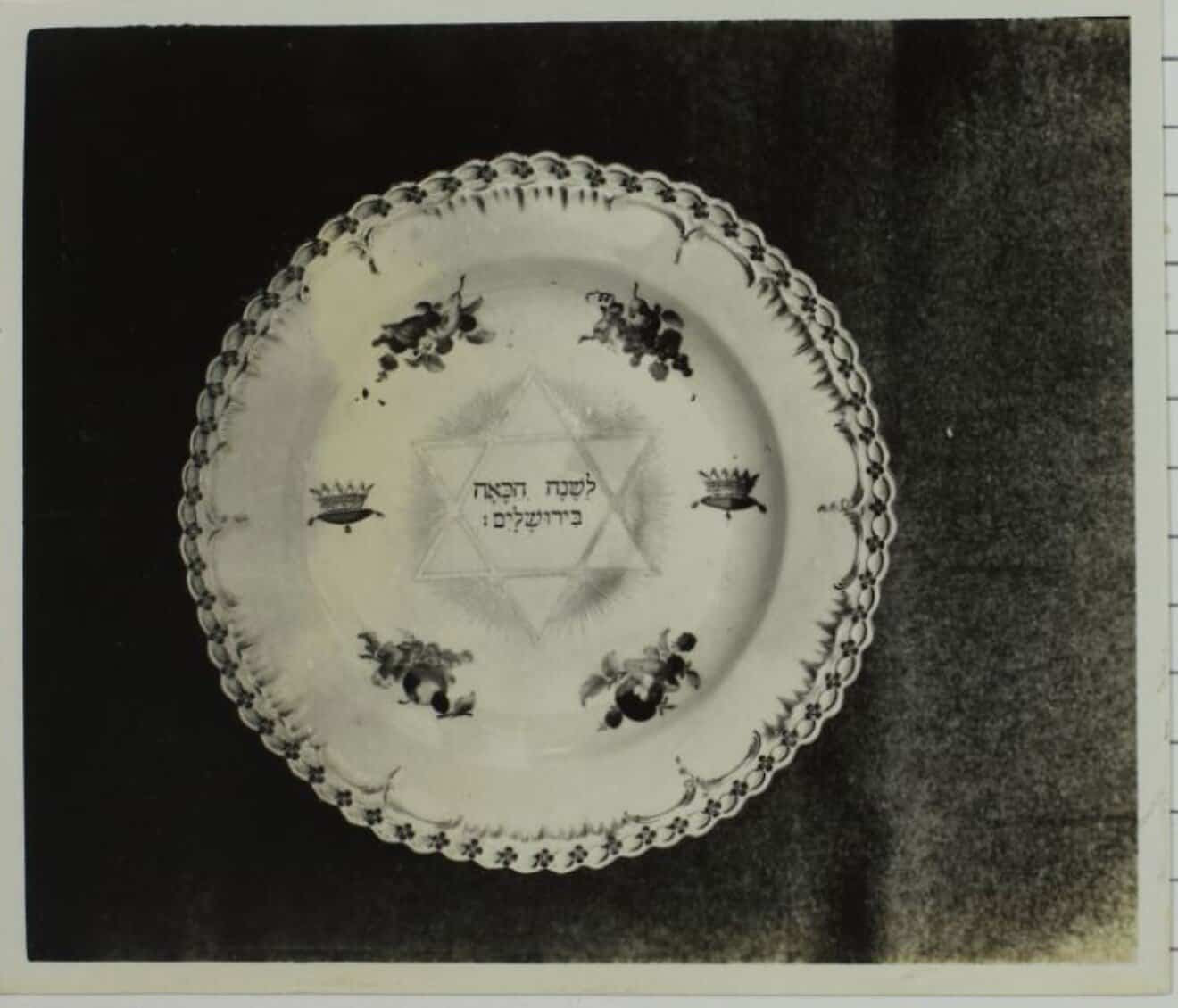

DISMANTLED: Hamas Command and Control Center 𝗜𝗻𝘀𝗶𝗱𝗲 Al Ahli Hospital

DISMANTLED: Hamas Command and Control Center 𝗜𝗻𝘀𝗶𝗱𝗲 Al Ahli Hospital